226.1K

43

$736

20

—

2

$1171

17

—

9

$737

14

—

14

$960

18

1.4M

6

$560

9

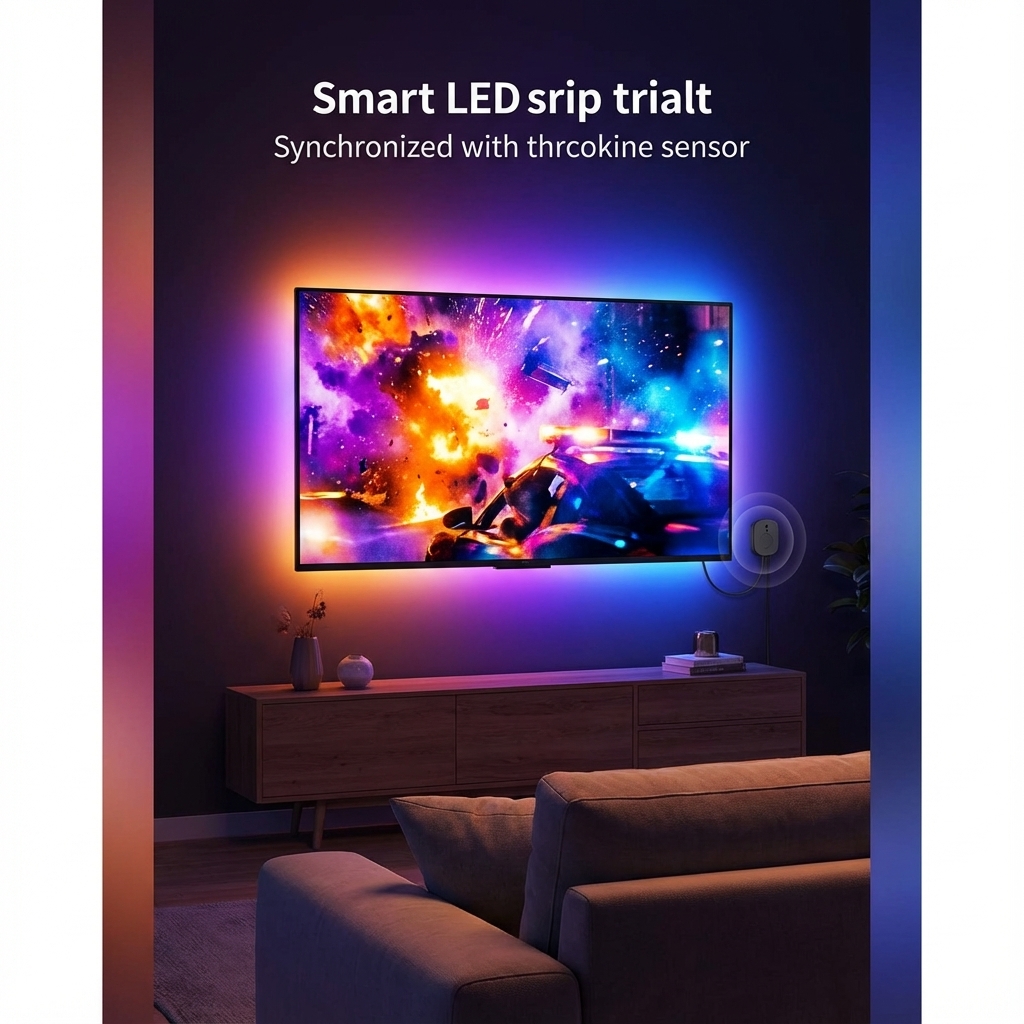

The LED strip market in Mexico is set for substantial growth by 2026, as consumer preferences shift from basic illumination to creating personalized and intelligent lighting environments. This evolution is spearheaded by the integration of smart technology, making features like smartphone app control, voice commands through assistants like Alexa and Google Home, and music synchronization the new standard. Consumers are no longer just lighting a room; they are curating an experience, demanding convenience and customization at their fingertips to adapt their surroundings to any mood or activity. Aesthetically, the trend is moving towards more sophisticated applications, such as using LED strips for indirect and layered lighting to add depth, warmth, and architectural interest to spaces. This marks a departure from traditional, harsh overhead lighting in favor of a more integrated and seamless look. The versatility of LED strips is also driving their popularity in both indoor and outdoor settings. The availability of durable and waterproof options is enabling creative and functional installations in gardens, on building facades, and even within swimming pools, effectively extending living spaces to the outdoors. An important emerging trend is the focus on wellness through human-centric lighting systems. This involves LED strips that can mimic natural daylight cycles, adjusting their color temperature and brightness throughout the day to support the body's circadian rhythm. By providing cooler, energizing light during the day and warmer, relaxing light in the evening, these systems aim to improve mood, boost productivity, and promote better sleep. This trend reflects a broader societal shift towards health and well-being, with consumers seeking technologies that actively contribute to a healthier home environment.

The LED Strip category is a dynamic and high-demand segment in the Mexican market, driven by powerful trends in smart home control, immersive entertainment, architectural accents, and wellness lighting. A clear market division offers distinct sourcing opportunities: a value segment focused on delivering reliability by solving common issues like poor adhesion and unstable app connectivity, and a premium segment that commands higher prices with advanced technologies like 'dotless' COB lighting, RGBIC multi-color effects, and seamless smart home integration. For brands aiming to capitalize on this trend, success hinges on addressing these core consumer needs. Partnering with a reputable led strip manufacturer is essential to deliver a quality product, whether it's a dependable basic or a feature-rich premium offering. Focusing on superior components and user-friendly features will allow brands to stand out and capture this growing market.

The market data and sourcing advantages that make this trend worth pursuing.

Typical range

$5.35–$25.99

Typical range

$27.46–$60.00

132K views • 9% engagement

Strong organic resonance

53 suppliers

MOQ flexibility & scale options

High-margin candidate for boutique retail.

Premium Suede Backpack

High-margin candidate for boutique retail.

Top-selling entry-level SKU on Amazon.

Supplier Examples

Supplier 1

MOQ 100 • 5+ yrs

Supplier 2

MOQ 100 • 5+ yrs

Supplier 3

MOQ 100 • 5+ yrs

Supplier 4

MOQ 100 • 5+ yrs

Supplier 5

MOQ 100 • 5+ yrs

Add or customize product features and we'll match you with verified suppliers.

Feature Matching

Find suppliers with matching capabilities

Quote Comparison

Compare pricing and lead times

Sampling & Production

Request samples and begin production

Minimum order quantities vary by supplier tier and product complexity. Value segment suppliers typically require 500-1,000 pieces per style/color, while premium manufacturers may accept 200-300 pieces for higher-value orders. Customization options like private labeling often increase MOQ requirements.

Common materials include cotton, polyester, modal, bamboo viscose, and various blends. Performance variants often incorporate spandex/elastane for stretch, while premium options may use pima cotton or Tencel. Material choice significantly impacts both FOB pricing and end-consumer appeal.

Request product samples before bulk orders, verify supplier certifications (ISO, BSCI, OEKO-TEX), check factory audit reports, and review trade history on B2B platforms. Our verified supplier ratings consider response rates, dispute history, and quality scores from verified transactions.

Standard production lead times range from 25-45 days depending on order complexity and supplier capacity. Rush orders may be possible at premium rates. Add 15-30 days for sea freight shipping to US ports, or 5-7 days for air freight on urgent orders.