8.3M

3

$7

19

—

16

$13

16

—

74

$10

15

—

0

$12

15

—

20

$9

15

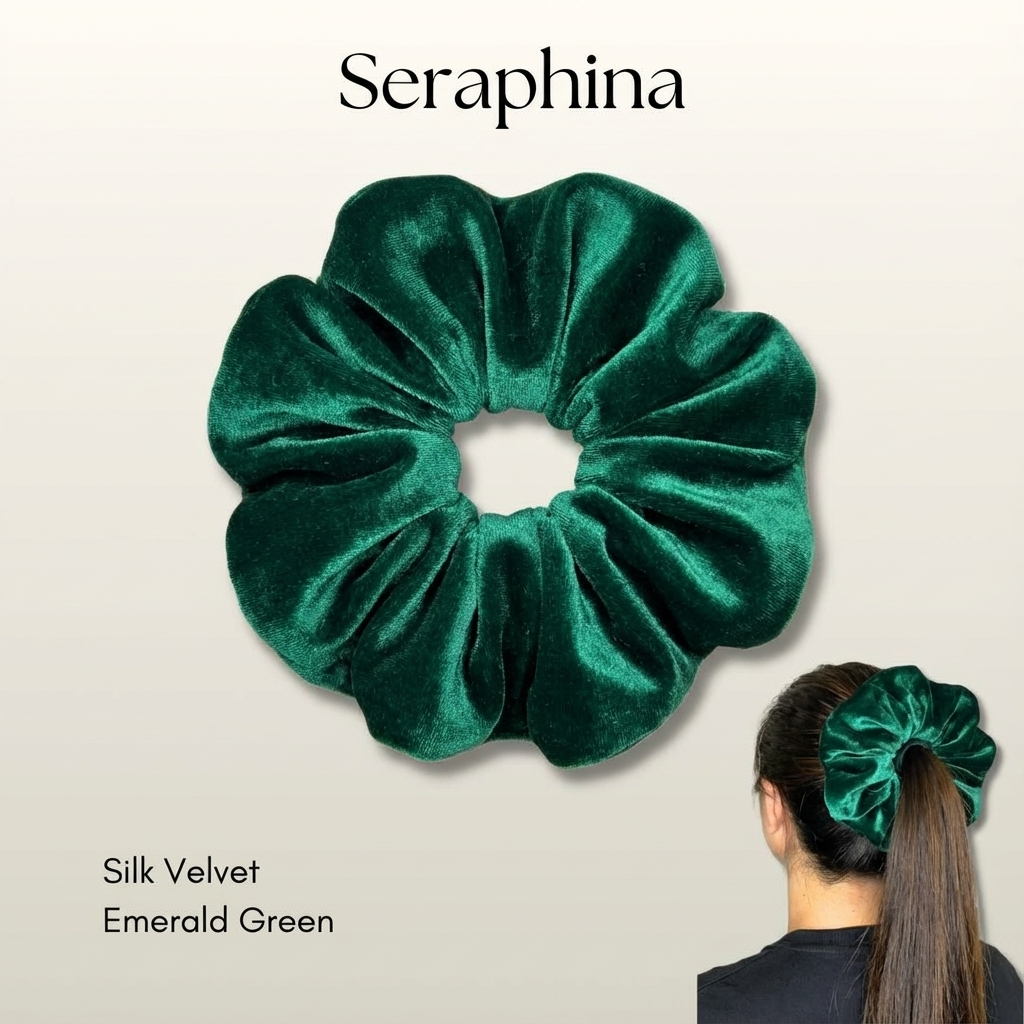

The upcoming seasons for hair ties are marked by a significant emphasis on both style and hair health. A prominent trend is the move towards accessories that are gentle on the hair, designed to prevent breakage and damage. This is evident in the widespread adoption of materials like silk and satin, which are favored for their ability to reduce friction and help preserve the hair's natural moisture and oils. This focus on hair wellness reflects a broader consumer shift towards self-care and preventative measures in beauty routines. Alongside the health-conscious movement, a powerful wave of nostalgia is influencing designs. '90s-inspired accessories, particularly oversized scrunchies and claw clips, are experiencing a major resurgence, updated with modern fabrics and proportions. Looking ahead to 2026, this trend evolves into a maximalist approach, with statement accessories set to dominate. Oversized and embellished pieces are expected to add a dramatic and fashionable flair to even the most simple hairstyles, allowing for bold self-expression. Sustainability has emerged as another crucial driver in the market, with a growing consumer demand for hair ties made from eco-friendly and biodegradable materials such as organic cotton and recycled fabrics. This reflects a more conscious approach to consumption. Finally, the "Balletcore" aesthetic continues to shape hair accessory trends, introducing a romantic and distinctly feminine touch through the popular use of bows and delicate ribbons, which add an elegant finish to various hairstyles.

Hair ties represent a dynamic and high-demand category in the US market, evolving from a simple commodity into a collection of distinct product archetypes. The market is clearly bifurcated, presenting dual opportunities for brands. The value segment is driven by consumer demand for durable, reliable solutions that solve common frustrations like snapping, snagging, and poor elasticity, making it a prime opportunity for sourcing hair ties in bulk. Concurrently, the premium segment is flourishing, with consumers seeking elevated aesthetics and hair-health benefits from materials like Mulberry silk and TENCEL™, or superior construction in spiral and bow ties. Across all styles—from oversized scrunchies to sustainable options—the key to success is addressing specific quality pain points. Brands that act quickly to source well-engineered products, whether focused on performance or luxury, can capture significant market share from consumers actively seeking better alternatives.

The market data and sourcing advantages that make this trend worth pursuing.

Typical range

$5.35–$25.99

Typical range

$27.46–$60.00

132K views • 9% engagement

Strong organic resonance

53 suppliers

MOQ flexibility & scale options

High-margin candidate for boutique retail.

Premium Suede Backpack

High-margin candidate for boutique retail.

Top-selling entry-level SKU on Amazon.

Supplier Examples

Supplier 1

MOQ 100 • 5+ yrs

Supplier 2

MOQ 100 • 5+ yrs

Supplier 3

MOQ 100 • 5+ yrs

Supplier 4

MOQ 100 • 5+ yrs

Supplier 5

MOQ 100 • 5+ yrs

Add or customize product features and we'll match you with verified suppliers.

Feature Matching

Find suppliers with matching capabilities

Quote Comparison

Compare pricing and lead times

Sampling & Production

Request samples and begin production

Minimum order quantities vary by supplier tier and product complexity. Value segment suppliers typically require 500-1,000 pieces per style/color, while premium manufacturers may accept 200-300 pieces for higher-value orders. Customization options like private labeling often increase MOQ requirements.

Common materials include cotton, polyester, modal, bamboo viscose, and various blends. Performance variants often incorporate spandex/elastane for stretch, while premium options may use pima cotton or Tencel. Material choice significantly impacts both FOB pricing and end-consumer appeal.

Request product samples before bulk orders, verify supplier certifications (ISO, BSCI, OEKO-TEX), check factory audit reports, and review trade history on B2B platforms. Our verified supplier ratings consider response rates, dispute history, and quality scores from verified transactions.

Standard production lead times range from 25-45 days depending on order complexity and supplier capacity. Rush orders may be possible at premium rates. Add 15-30 days for sea freight shipping to US ports, or 5-7 days for air freight on urgent orders.