Complete sourcing guide for Gentle Gel Cleanser including supplier directory, FOB pricing, product specifications, and market validation.

FOB Price Range

$6.65 - $52.61

Verified Suppliers

1

Sourcing Strategies

2

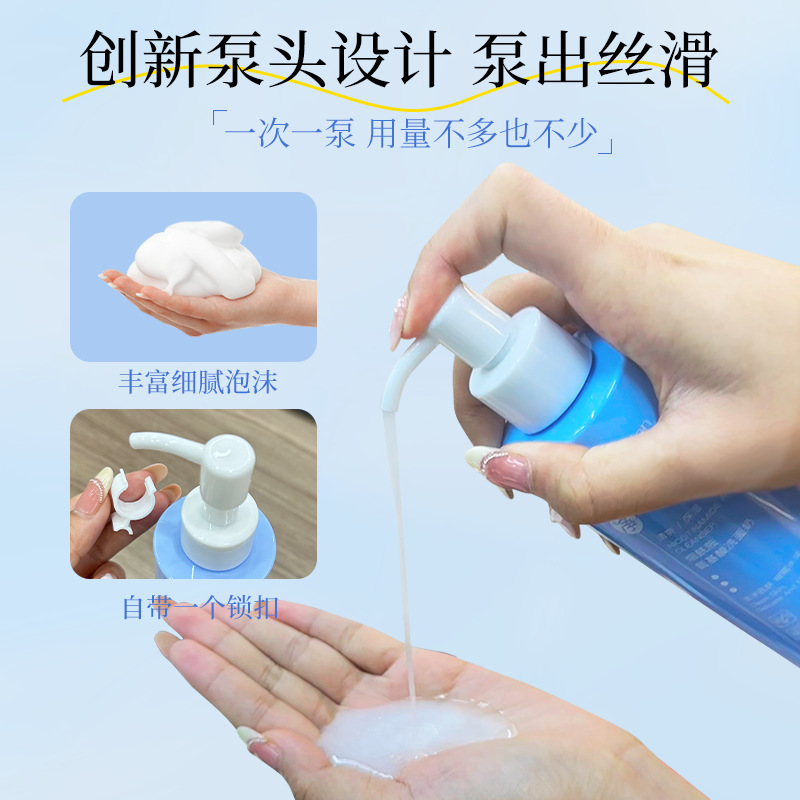

AI-generated product visualizations for Gentle Gel Cleanser

A quick preview of supplier standards, production requirements, and sourcing intelligence from our verified network.

Verified suppliers with years of experience and quality strengths

| Supplier | Images | Tier | Years | Response | Favorites | Key Strengths | Product Expertise | Shop Ratings | Contact |

|---|---|---|---|---|---|---|---|---|---|

Guangzhou Yuanshengyuan Cosmetics Co., Ltd. No. 26, Huasheng North Road, Xicheng Industrial Park, Renhe Town, Baiyun District, Guangzhou City, Guangdong Province | Tier 2 | 5+ | 0.82% | 11.7k | Good DisputeGood Service | Liquid EssenceCleansing ProductsFacial Care Set | Quality 2.0 Returns 3.3 Logistics 3.9 Consult 3.5 Dispute 4.0 Overall 4.0 | View contact |

0 verified suppliers across 6 manufacturing hubs

Average Ratings Across All Suppliers

0.0

Quality

0.0

Logistics

0.0

Returns

0.0

Disputes

0.0

Support

0.0

Overall

FOB pricing by manufacturing cluster, compare costs across regions

| Region | Suppliers | Min FOB | Avg FOB | Max FOB |

|---|---|---|---|---|

| Guangzhou, Guangdong | 10 | ¥1 | ¥5 | ¥28 |

| Foshan, Guangdong | 4 | ¥1 | ¥1 | ¥3 |

| Yunfu, Guangdong | 3 | ¥1 | ¥4 | ¥9 |

| Zhaoqing, Guangdong | 3 | ¥1 | ¥1 | ¥2 |

| Shantou, Guangdong | 2 | ¥1 | ¥2 | ¥3 |

| Qingyuan, Guangdong | 1 | ¥3 | ¥3 | ¥3 |

Guangdong province solidifies its position as the core manufacturing region for gentle gel cleansers, with Guangzhou leading as a dominant hub. Guangzhou's robust supply chain for raw materials and packaging, complemented by cost-effective production clusters in nearby cities like Foshan and Zhaoqing, creates a comprehensive sourcing ecosystem with significant export advantages.

Best For: Sourcing a diverse range of gentle gel cleansers, from innovative formulations to high-volume production, with fast-paced development cycles.

Why Strong: As a dominant force in China's cosmetics industry, Guangzhou offers a mature industrial base, a complete supply chain for raw materials and packaging, and significant R&D capabilities. The wide pricin...

⚠️ The wide variation in pricing and supplier capabilities requires careful vetting to ensure a good match for specific quality, innovation, and cost req...

Best For: High-volume, mass-market gentle gel cleansers where achieving a competitive price point is the primary objective.

Why Strong: This cluster is characterized by highly competitive pricing and its proximity to the larger Guangzhou ecosystem. It leverages the Pearl River Delta's logistical network while focusing on cost-efficien...

⚠️ The focus on cost may translate to less emphasis on premium ingredients, complex formulations, or bespoke packaging options.

Best For: Finding alternative suppliers for mid-tier products or diversifying a supply chain within the Guangdong region.

Why Strong: An alternative sourcing location within the broader Guangdong cosmetics belt. It offers a mid-range price point, providing a balance between the high-end options in Guangzhou and the ultra-low-cost cl...

⚠️ A smaller supplier base means fewer choices and potentially less specialization compared to the primary hub of Guangzhou.

Top-tier verified manufacturers with quality ratings and capabilities

| Company | Tier | Years | Quality | Logistics |

|---|---|---|---|---|

| Guangzhou Yuanshengyuan Cosmet... | TIER 2 | 5+ | 2.0 | 3.9 |

| Supplier | Yrs | Rating ↓ | Actions |

|---|

Tip: Click on a supplier row to see detailed ratings breakdown. Ratings above 4.0 indicate reliable suppliers.

The primary cost drivers for a gel cleanser are the active ingredients, the formula's base and viscosity, and the packaging. To optimize for price, start by substituting premium actives like Ceramides with cost-effective alternatives like Glycerin or Panthenol. Next, simplify packaging by choosing a standard tube over a custom pump bottle. Finally, increasing order volume will unlock significant price breaks.

Confidence: High| Pricing Lever | Cost Impact | Quality Risk | MOQ Impact | Lead Time | Notes |

|---|---|---|---|---|---|

| Substitute premium actives (e.g., Ceramides) with cost-effective ones (e.g., Glycerin, Panthenol) | ↓ High | Medium | - None | - None | Still delivers strong soothing/hydrating benefits but may affect premium positioning. Requires formulation expertise to maintain efficacy. |

| Switch from pump bottle to squeeze tube with flip-top cap | ↓ Medium | Low | - None | ↓ Low | Reduces packaging cost and mitigates common risk of pump failure and leakage during shipping. |

| Use stock bottle/tube molds instead of custom shapes | ↓ Medium | Low | ↓ Low | ↓ High | Eliminates high upfront mold fees and long lead times. Less brand differentiation. |

| Reduce formula viscosity or simplify surfactant blend | ↓ Low–Medium | High | - None | - None | Risks creating a 'thin and watery' texture, a common negative customer review. May affect lathering performance. |

| Opt for a fragrance-free formula | ↓ Low | Low | - None | ↓ Low | Eliminates fragrance cost and development time. Broadens appeal to sensitive skin users, a key premium segment feature. |

| Reduce packaging size (e.g., 200g to 150g) | ↓ Low | Low | - None | - None | Directly reduces component and fill costs. Risks negative perception of being 'smaller than anticipated'. |

| Increase MOQ (e.g., from 3k to 10k units) | ↓ Medium–High | Low | ↑ High | - None | Unlocks significant price breaks from suppliers for both raw materials and packaging components. |

| Remove outer retail box | ↓ Low | Medium | - None | ↓ Low | Reduces paper and printing costs but increases risk of scuffing/damage to primary packaging during transit. |

Ready to formulate your perfect cleanser? Submit a sourcing request with your target ingredients and price point, and we'll connect you with qualified cosmetic labs.

The most frequent and damaging quality issues are packaging failures like leaking pumps, formula inconsistencies such as a 'watery' texture or poor lather, and the absence of safety seals, which erodes consumer trust. These issues often lead to negative reviews and returns.

Confidence: HighRoot Cause

Low-quality pump mechanism; poor seal design; incorrect assembly torque; damage during shipping.

What to Specify / Ask Supplier

Specify pump brand/model (e.g., with locking mechanism). Require vacuum leak testing and define assembly torque. Specify protective packaging.

QC Check (What "Good" Looks Like)

Cycle pump 20x on 10 sample units. Invert and apply pressure to check for leaks. Check for consistent locking action.

Root Cause

Lack of viscosity control in production; poor formulation stability; incorrect mixing procedure or temperature.

What to Specify / Ask Supplier

Provide a 'golden sample' for reference. Specify a target viscosity range in centipoise (cps) (e.g., 8,000-12,000 cps).

QC Check (What "Good" Looks Like)

Visually compare production sample flow rate against the golden sample. Use a viscometer for objective measurement.

Root Cause

Process oversight at the factory; cost-cutting by omitting the seal; using a cheap, non-adherent seal.

What to Specify / Ask Supplier

Mandate a specific seal type (e.g., induction seal on bottle opening, or external shrink band over cap).

QC Check (What "Good" Looks Like)

Visually confirm presence of seal on every unit. Attempt to peel seal to ensure it's properly adhered and tamper-evident.

Root Cause

Formula pH is out of spec (too high/low); use of harsh surfactants (e.g., SLS); concentration of actives is too high.

What to Specify / Ask Supplier

Specify a skin-friendly pH range (e.g., 5.0-6.0). Require a sulfate-free formula. Request Human Repeat Insult Patch Test (HRIPT) data.

QC Check (What "Good" Looks Like)

Test the pH of the batch using a calibrated pH meter or pH strips to ensure it's within the specified range.

Root Cause

Unstable formula; exposure to extreme temperatures during shipping/storage; reaction between formula and packaging.

What to Specify / Ask Supplier

Require stability test results (e.g., 3 months at 40°C/104°F). Confirm packaging compatibility testing was performed.

QC Check (What "Good" Looks Like)

Visually inspect samples for clarity, uniform color, and any signs of ingredient separation or precipitation. Check top, middle, and bottom of batch.

Root Cause

Ineffective preservative system; non-compliance with Good Manufacturing Practices (GMP) during production.

What to Specify / Ask Supplier

Require proof of GMP certification. Request Preservative Efficacy Test (PET) results. Require a Certificate of Analysis (COA) with micro results for each batch.

QC Check (What "Good" Looks Like)

Smell test for any 'off' or sour odors. Visually check for cloudiness or mold. Send samples to a 3rd party lab for microbial plate count.

Root Cause

Low-quality raw materials; formula instability leading to degradation; interaction with packaging.

What to Specify / Ask Supplier

Provide an approved scent sample. If fragrance-free, specify that it must be low-odor. Request a list of raw material suppliers.

QC Check (What "Good" Looks Like)

Smell the production sample and compare it against the approved 'golden sample'. Note any sour, plastic, or chemical off-notes.

Don't let quality issues sink your launch. Source with us and we'll build a comprehensive QC checklist and inspection plan tailored to your Gentle Gel Cleanser.

Use this data to create your product specifications, reach out to suppliers, and validate your pricing strategy. Start with small sample orders to test quality.

Real product samples with pricing, MOQ, and supplier ratings

| Product | Title | MOQ | Price (CNY) | Price (USD) | Sale QuantityHow many units sold | OrdersHow many orders in Alibaba/1688 | Rating | Tiered Pricing | Key Features | Link | Action |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Niacinamide Amino Acid Facial Cleanser Long-Lasting Oil Control Blackhead Remover Press-Type Hydrating Moisturizing Women's Big Brand Facial Cleanser | 1 | ¥3.80 | $3.42 | 6,301 | 40 | 2.0 |

| ShiyiquanNormal SpecificationDomestic Brand | Source Item |

Choose from 2 pricing strategies based on your target market

This sourcing playbook provides actionable guidance for importing Gentle Gel Cleanserproducts. Our data-driven approach combines supplier intelligence with market validation to help you make informed purchasing decisions and minimize sourcing risks.

First orders typically require 30-50% deposit with balance before shipment (T/T). As relationships develop, suppliers may offer 30/70 splits or even open terms for established buyers. Letter of Credit (L/C) is available for larger orders but involves additional fees.

Document issues with photos immediately upon receipt. Most suppliers offer replacement or credit for legitimate defects within agreed AQL limits. Having clear quality specifications in your purchase order strengthens your position in disputes.

Third-party inspection is recommended for first orders and orders over $10,000. Services like SGS or Bureau Veritas cost $200-400 per inspection and can prevent costly quality issues. Pre-shipment inspection is most common; in-line inspection adds additional assurance.

Navigation: All Categories → Cleanser → Gentle Gel Cleanser → Sourcing