June 2, 2024

As the 90s interior aesthetic makes a striking comeback in 2025, brands and retailers have a golden opportunity to leverage nostalgia while offering c...

Read more

February 5, 2025

Selling on Amazon continues to be one of the most accessible and profitable ways to grow a product-based business. But behind every successful listing...

Read more

March 5, 2024

Choosing the right sourcing strategy is one of the most important decisions for any business looking to expand its product line. Whether you’re a star...

Read more

December 2, 2025

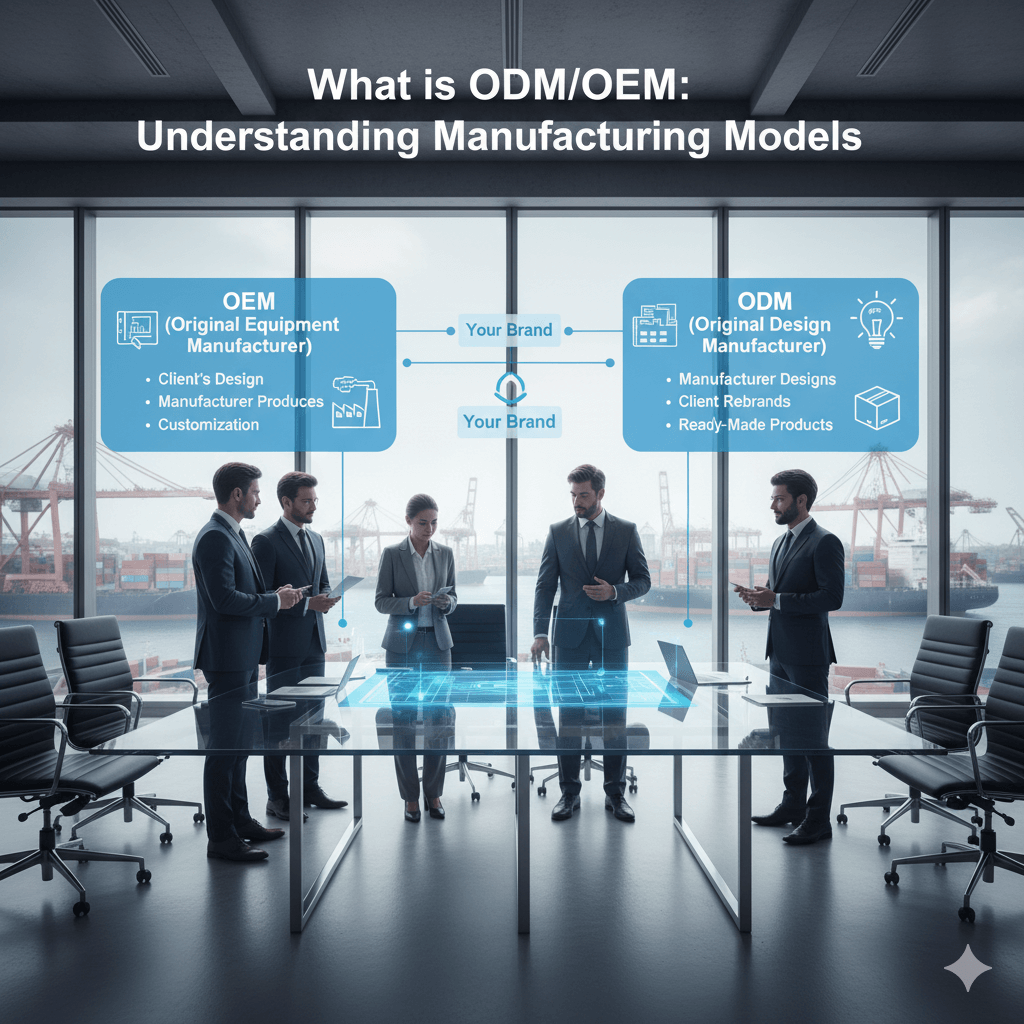

When it comes to developing products, businesses often face crucial decisions about manufacturing models that impact design, production, and branding....

Read more

July 15, 2024

The U.S. market for drones is diverse, catering to users from beginners to seasoned enthusiasts. With options ranging from basic models to high-defini...

Read more

April 16, 2024

Jigsaw puzzles are a timeless pastime, loved by families, hobbyists, and casual players alike. Understanding the trends and preferences in the puzzle ...

Read more

June 28, 2024

Necklaces remain a cornerstone of women’s fashion, transforming any outfit into a statement of personal style. As we enter 2025, trends in women’s nec...

Read more

August 12, 2024

The US market for food jars and canisters is evolving, driven by consumer preferences for functionality, aesthetics, and sustainability. As we look ah...

Read more

February 3, 2025

A Comprehensive Guide for Procurement Teams and Supply Chain LeadersSourcing is the process of finding and selecting suppliers to provide the products...

Read more