Verified suppliers, target pricing, specifications, and sourcing risks—everything you need to move from idea to production.

Trend signals, demand data, and market insights for this product

$1.21

1-3 units

5-10 days

Anhui, Guangdong

Medium

Your pricing, materials, supplier type, and MOQ depend on this decision.

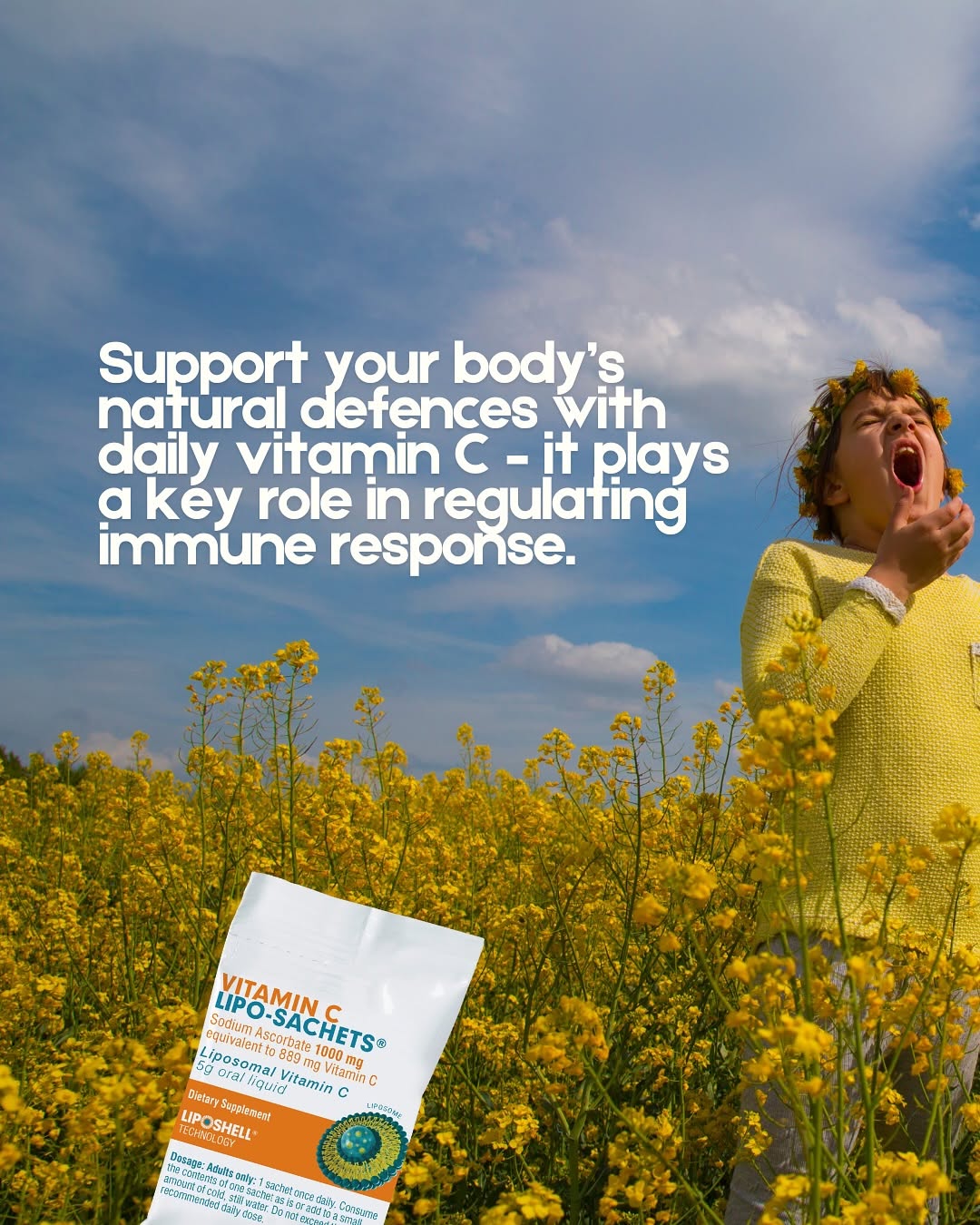

To win the value segment, we will launch a daily immunity support sachet that directly addresses the top customer compla...

MOQ: 200 - 500 units

Our premium offering will be a sophisticated, multi-functional wellness formula for the discerning health-conscious cons...

These manufacturers match the selected pricing, MOQ and quality requirements.

Real products available from verified suppliers in this category.

Recommended specifications based on market demand and supplier feasibility.

| Parameter | Recommendation | Rationale |

|---|---|---|

| Core Ingredients | 1000mg Vitamin C and 10-15mg Zinc per serving. | This combination is the market standard for effective immunity support. It meets customer expectations for a product that provides an energy boost and helps reduce cold severity, while also addressing the preference for moderate, not excessively high, vitamin levels for better absorption. |

| Flavor Profile | Natural Orange or Berry flavor, optimized to be pleasant and not artificial. | Flavor is the single most critical factor for satisfaction. This spec directly targets the top negative insight about 'unpleasant, artificial, or overly weak flavor' and aligns with the positive insight that a 'pleasant, natural-tasting flavor' drives repeat purchases. |

| Sweetener System | Sugar-free formula using Stevia or a similar natural sweetener. | Caters directly to the positive insight that a 'sugar-free version is a major selling point' for health-conscious consumers. Using a natural sweetener helps avoid the 'artificial' taste complaint common in this segment. |

| Dissolvability & Texture | Quick-dissolving effervescent powder that leaves no residue or gritty aftertaste. | Addresses a key quality perception. Positive reviews praise formulas that 'dissolve quickly and completely', while poor dissolvability is a frequent complaint. This ensures a superior user experience. |

| Quality Assurance | Strict moisture control during production and packaging to prevent powder hardening. | Directly mitigates the critical negative insight of 'hardened or crystallized powder', which destroys customer trust and indicates poor quality. This is a non-negotiable standard to ensure product integrity. |

| Packaging | 30 individual, easy-to-tear sachets per box. | Aligns with positive feedback praising 'individually wrapped sachets' for their on-the-go convenience. A 30-count pack encourages daily use and positions the product as a monthly supply for 'daily defense'. |

Depth information for decision-making - not the primary driver.

Submit your design with target specs, and we'll connect you with vetted manufacturers.