Verified suppliers, target pricing, specifications, and sourcing risks—everything you need to move from idea to production.

Trend signals, demand data, and market insights for this product

$8.28

1-3 units

5-10 days

Guangdong, Guangdong

Medium

Your pricing, materials, supplier type, and MOQ depend on this decision.

The value segment strategy is to launch a reliable, high-protection SPF 50 facial sunscreen that builds trust by directl...

MOQ: 200 - 500 units

The premium segment strategy is to launch a sophisticated, high-performance 'serum-sunscreen' that delivers a superior s...

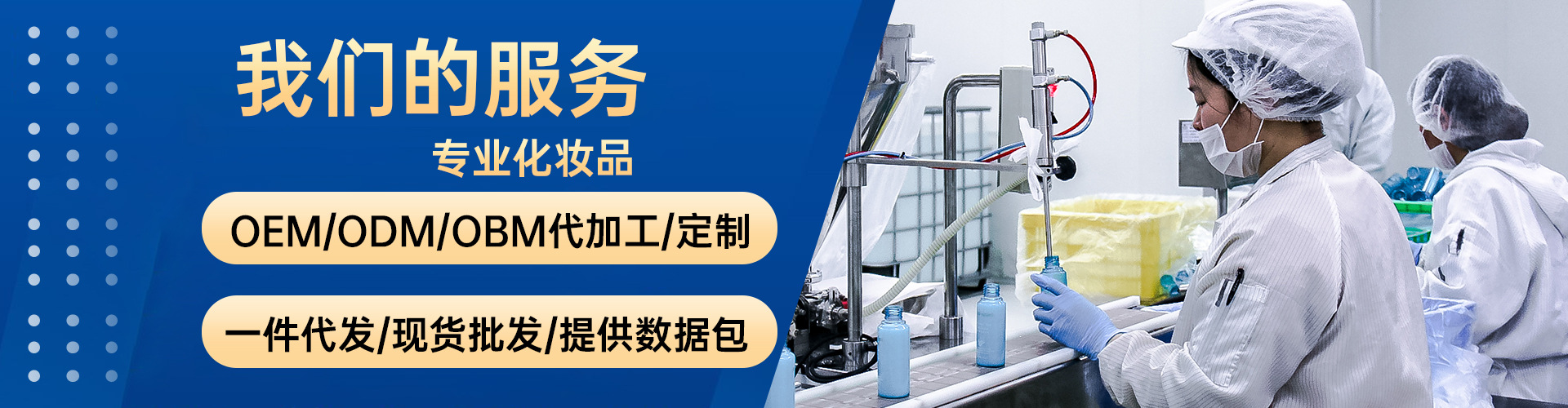

These manufacturers match the selected pricing, MOQ and quality requirements.

Real products available from verified suppliers in this category.

Recommended specifications based on market demand and supplier feasibility.

| Parameter | Recommendation | Rationale |

|---|---|---|

| Sun Protection Factor (SPF) | SPF 50, Broad Spectrum, Clinically Proven | Matches competitor offerings of SPF 50/60 but adds 'Clinically Proven' to directly counter the severe negative insight of users getting sunburned. This builds trust and justifies the core function. |

| Texture & Finish | Lightweight, Fast-Absorbing Gel-Cream with a Dry, Non-Sticky Finish | Directly targets the most-loved positive insight for a lightweight, dry finish, making it ideal for oily skin. It also solves the major negative complaint about products being oily, sticky, or pilling. |

| Product Volume | 50ml | Addresses the significant negative insight of products being 'smaller than they appear'. 50ml is a standard, substantial size that feels like good value and avoids customer disappointment, while still being travel-friendly. |

| Key Active Ingredient | Salicylic Acid (0.5%) | Competitors use Salicylic Acid to target acne and oily skin, which are common concerns. Including a low, effective concentration adds a clear benefit for a key user group without significantly increasing cost. |

| Primary Packaging | 50ml Opaque Squeeze Tube with Flip-Top Cap | A squeeze tube is cost-effective for the value segment. It is also more durable for shipping than pump bottles, addressing the negative insight about products arriving broken or leaking. |

| Fragrance | Light, Hypoallergenic Fresh Scent | Responds to the positive feedback for pleasant, light fragrances while using a hypoallergenic formula to mitigate the risk of skin allergies and irritation, a major negative point for competitors. |

| On-Pack Information | Full ingredients and instructions in Portuguese | Directly solves the critical negative insight about the lack of instructions in the local language, improving user experience and ensuring correct application. |

Depth information for decision-making - not the primary driver.

Submit your design with target specs, and we'll connect you with vetted manufacturers.